How to save money on a low income in India? This is a question that resonates with millions of hardworking individuals across the country. Whether you are a daily wage worker, a contract-based employee, a small shopkeeper, or someone just starting a job, saving money often feels like a luxury you cannot afford. But the truth is, saving is not about how much you earn—it’s about how well you manage what you have.

In this comprehensive guide, you will learn practical strategies, tools, and insights to build the habit of saving, even if your income is small. Let’s explore how every rupee you earn can be stretched, protected, and grown over time.

1. Develop the Right Financial Mindset

The journey to saving money begins in the mind. Most people believe that savings should come from what’s left after spending. But when you have a low income, there’s often nothing left at the end of the month. This is why the golden rule is: Save first, spend later.

No matter how small your earnings are, setting aside even ₹100 to ₹300 right after receiving your income builds the foundation for long-term discipline. When you treat savings as a non-negotiable part of your monthly plan—like rent or food—it becomes a habit rather than a burden.

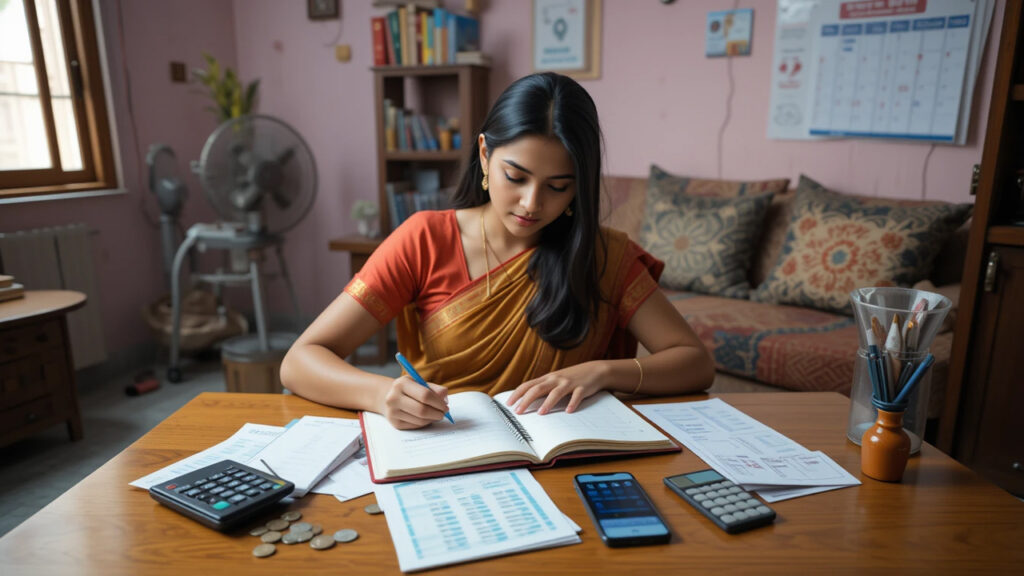

One of the biggest barriers to saving money is not knowing where your money goes. Tracking expenses may seem tedious, but it’s the most powerful way to gain control over your finances.

Start by writing down every rupee you spend for an entire month. Use a simple notebook or expense-tracking apps like Money View or Walnut. Be honest and include everything—from tea stalls and recharge coupons to snacks and cab rides.

You will likely discover that you’re spending more than expected on small, unnecessary items. Once you identify these spending leaks, you can make conscious choices to reduce or eliminate them and redirect that money toward savings.

3. Create a Realistic Monthly Budget

Budgeting is not only for the rich. It’s the most essential financial skill, especially when your income is limited. Creating a practical monthly budget helps you prioritize essentials, avoid unnecessary expenses, and plan ahead for savings.

Start by listing your income sources. Then divide your expenses into two categories:

- Fixed expenses (rent, school fees, electricity, EMIs)

- Variable expenses (groceries, transport, mobile recharge, entertainment)

Allocate a portion—at least 5% to 10%—of your income strictly for savings. If you’re earning ₹12,000, try to save ₹600–₹1,000 monthly. Use the envelope method or free budgeting apps like Goodbudget to stick to your plan. Even a basic structure will help you avoid financial surprises and spend wisely.

4. Cut Down on Non-Essential Spending

Reducing expenses is one of the fastest ways to start saving. And in India, where everyday costs vary significantly across brands and services, there are many ways to cut down without sacrificing your lifestyle.

Cook meals at home instead of ordering food. Travel by metro or bus instead of autos or cabs. Buy local, unbranded goods that serve the same purpose as expensive branded ones. Limit your spending during festivals or social events by planning ahead and avoiding last-minute purchases.

Think about your daily habits—do you spend ₹50–₹100 on tea, snacks, or cigarettes daily? Cutting back on such expenses can help you save ₹1,500–₹3,000 a month, which is a huge amount for someone on a limited income.

5. Open a Zero-Balance Bank Account

Having a separate savings account can protect your money from being spent impulsively. In India, you can open a zero-balance savings account through schemes like the Pradhan Mantri Jan Dhan Yojana (PMJDY). Banks like SBI, Canara Bank, and Bank of Baroda offer accounts that don’t require any minimum balance and come with ATM cards, mobile banking, and insurance cover.

Once your salary or income is received, transfer a fixed amount to this savings account. Keep this account untouched for regular spending. You can also automate the savings transfer using standing instructions or UPI apps.

6. Build an Emergency Fund Slowly

Emergency situations like illness, job loss, or house repair can hit you unexpectedly. Without savings, you may be forced to borrow money at high interest or depend on others. That’s why building an emergency fund is critical.

Start by saving ₹100 or ₹200 per week in a separate account or a physical money box. Your goal should be to build at least ₹5,000 to ₹10,000 over time. Apps like Jar allow you to save small daily amounts automatically by rounding off your transactions and investing the change in digital gold.

Having an emergency fund not only provides financial support but also gives you peace of mind during uncertain times.

7. Use Government Schemes Meant for Low-Income Groups

The Indian government offers various welfare schemes to help low-income families save money on health, education, housing, and food. Many of these schemes are underutilized due to a lack of awareness.

Here are a few schemes you should explore:

- Ayushman Bharat Yojana: Provides ₹5 lakh health coverage for families below the poverty line.

- Sukanya Samriddhi Yojana: High-interest savings scheme for girls with tax-free returns.

- Ujjwala Yojana: Free LPG connections for women from BPL families.

- Atal Pension Yojana: Pension scheme for informal workers.

- Public Distribution System (PDS): Subsidized food grains for eligible households.

Visit your local CSC center or gram panchayat to check eligibility and apply for these schemes.

8. Invest in Small, Safe Savings Instruments

Once your emergency fund is in place and your savings habit is strong, it’s time to grow your money. Even small investments can generate long-term wealth when done consistently.

If you are a beginner, start with Recurring Deposits (RDs) offered by banks or post offices. You can start with just ₹500 a month and get fixed returns of 6% to 7% per annum.

Another option is to begin a Systematic Investment Plan (SIP) in mutual funds through platforms like Groww, Zerodha Coin, or ET Money. SIPs can be started with as little as ₹100 per month.

Always choose conservative or hybrid funds as a beginner, and invest only the money you won’t need for 1–3 years.

9. Look for Additional Sources of Income

When expenses cannot be cut further, increasing income is the only path to saving more. Fortunately, there are many ways to earn extra income in India—even with limited time and resources.

You can offer tuition classes, do freelance work, sell handmade items online, start a tiffin service, or work as a delivery partner on weekends. You can also resell clothing or accessories using platforms like Meesho, FlipKart, Amazon.

Even earning ₹2,000 to ₹5,000 extra per month from side jobs can give your savings a big boost without compromising your main source of income.

10. Educate Yourself Financially

The most powerful tool to improve your financial life is knowledge. Fortunately, learning about money in India is now easier than ever thanks to YouTube, blogs, podcasts, and government portals.

Here are some YouTube channels to follow:

- CA Rachana Phadke Ranade – Great for beginners in Hindi and English.

- FinnovationZ – Explains finance concepts in simple Hindi.

- Asset Yogi – Focuses on investing, tax saving, and budgeting tips.

Make it a habit to spend 30 minutes per week learning about personal finance. This knowledge helps you make better decisions, avoid scams, and plan for the future confidently.

Conclusion

Learning how to save money on a low income in India is not about becoming rich overnight—it’s about being smart, disciplined, and aware. No matter how small your income, consistent habits like budgeting, reducing unnecessary spending, using government schemes, and investing wisely can change your financial future.

Start today by taking one step—track your expenses, save ₹100, or apply for a welfare scheme. Over time, these small efforts will build into a financial cushion that protects you and your family. Remember, saving is not about the amount—it’s about the habit.

FAQs

Q1. Can I really save money if my income is less than ₹10,000 per month?

A: Yes, by tracking expenses, cutting unnecessary costs, and saving ₹200–₹300 monthly, you can build a strong savings habit.

Q2. What is the safest saving tool for low-income earners in India?

A: Recurring Deposits in post offices or nationalized banks are safe and offer fixed returns.

Q3. Are mobile apps safe for money management?

A: Yes, apps like Money View, Walnut, and Jar are secure and widely used for budgeting and savings.

Q4. How much should I save every month?

A: Try saving at least 5% to 10% of your monthly income. If you earn ₹12,000, aim for ₹600–₹1,200.

Q5. Which government scheme is best for healthcare?

A: Ayushman Bharat offers free health coverage of ₹5 lakh for eligible families.

Q6. What is an emergency fund and why is it important?

A: It’s a savings buffer for unexpected events. It protects you from debt and financial stress.

Q7. Should I start SIPs even if I earn a small salary?

A: Yes, you can start a SIP with ₹100–₹500/month. Choose low-risk funds for safety.

Q8. What if I can’t cut any more expenses?

A: Look for side income opportunities like tuition, freelancing, or delivery jobs to increase your total income.

Q9. How do I educate myself about saving and investing?

A: Follow YouTube channels like CA Rachana Ranade, read financial blogs, and use government investor portals.

Q10. How can I build the habit of saving regularly?

A: Automate savings, use separate bank accounts, and make small daily contributions to stay consistent.