Managing money wisely has become more important than ever, especially for middle-class Indian families who juggle between daily expenses, EMIs, education costs, and dreams of a better future. A monthly budget isn’t just about cutting costs—it’s about gaining control over your income and ensuring a stable and secure financial life. In this article, we’ll guide you step-by-step on how to create a monthly budget, even if you’ve never done it before.

Understanding Your Family’s Monthly Income

The first step to creating a monthly budget is knowing how much money you actually bring home every month. Many people make the mistake of planning their expenses based on their gross salary. But what really matters is your take-home pay—what lands in your bank account after taxes and deductions. Apart from your main salary, if you have any side income, rental income, or interest from savings, include those too. Be honest and realistic. If income varies slightly each month, take an average based on the last three months.

Track Your Expenses Honestly

Before you can plan where your money should go, you need to know where it’s already going. Take one full month and note down every single rupee you spend. This includes your rent, groceries, utility bills, school fees, fuel, medical expenses, eating out, subscriptions, and even chai from the roadside stall. Many people are shocked to see how much they spend on small, daily things. Once everything is recorded, divide your spending into fixed expenses like rent or EMIs, and variable ones like food, travel, or entertainment.

Needs vs Wants: The Big Difference

One of the most important budgeting lessons is understanding the difference between needs and wants. Needs are the things your family truly requires to survive and function—like housing, groceries, education, and transport. Wants, on the other hand, are lifestyle choices—eating out frequently, buying new clothes every month, or going on weekend trips. It’s not wrong to spend on wants, but if you’re spending too much on them, it may hurt your savings or leave you in debt. A good budget always prioritizes needs first.

Define Your Financial Goals

Budgeting becomes more meaningful when you tie it to a purpose. Ask yourself what your family is trying to achieve financially. Do you want to save for a child’s education? Build an emergency fund? Buy a car? Pay off credit card debt? These goals can be short-term or long-term. Once goals are clear, you’ll be motivated to set aside money every month toward achieving them. It’s like planning a trip—you need to know your destination to choose the right route.

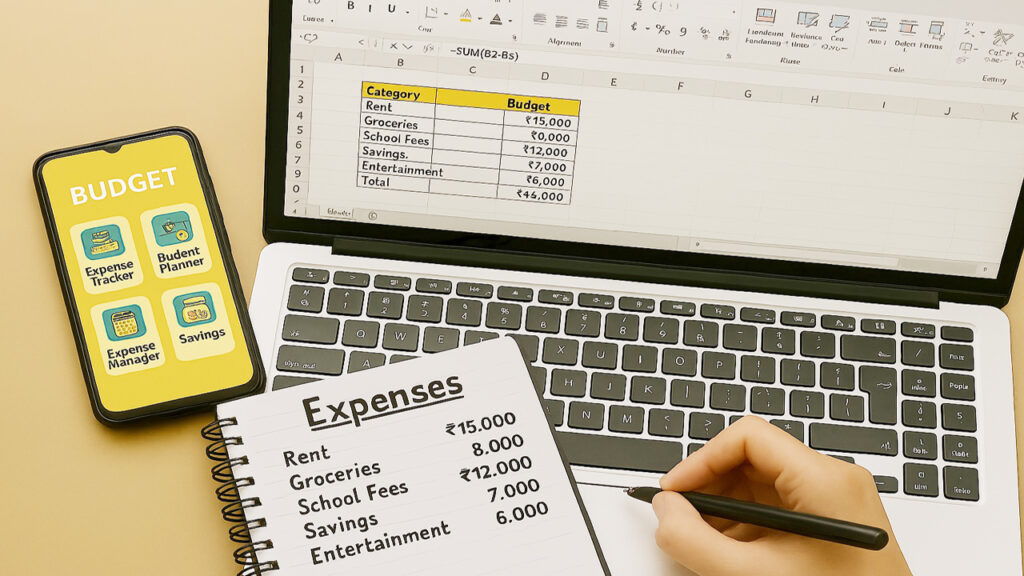

Divide and Allocate Your Income

Once you know your monthly income and have a good understanding of your spending habits, you can now plan how much to allocate to each category. For example, if you earn ₹60,000 per month, you might decide to keep ₹15,000 for rent, ₹8,000 for groceries, ₹5,000 for children’s school fees, ₹7,000 for EMI payments, and so on. You’ll also want to set aside a fixed amount for savings every month—ideally before you spend anything else. This approach is known as “paying yourself first.”

Try the 50/30/20 Rule (Modified for India)

A popular and simple method of budgeting is the 50/30/20 rule. It suggests you spend 50% of your income on needs, 30% on wants, and 20% on savings. For a ₹60,000 income, that would mean ₹30,000 for essentials, ₹18,000 for lifestyle choices, and ₹12,000 for saving or investing. Of course, Indian families may need to tweak this rule a bit. In cities with high rent, needs might take up 60% or more of the budget, leaving you with less flexibility. What matters most is that your savings don’t get ignored.

Use Tools to Track Your Budget

To stay on track, it’s important to review your budget at least once a week. You can use a simple notebook, a spreadsheet on your computer, or mobile apps like Walnut, Money Manager, or Goodbudget. Choose whatever method feels easiest for you. The goal is not to make it complex—but to make sure you’re regularly checking your progress and adjusting if you overspend in any area.

Save Smarter Every Month

Even with a tight budget, there are many small ways to save money. Cooking meals at home instead of ordering food, buying household items during sales, using cashback apps, choosing prepaid mobile plans, and cutting out unnecessary subscriptions can all help. Sometimes we don’t realize how small leaks in our budget—like spending ₹2,000 a month on unplanned online shopping—can affect long-term goals. By identifying and controlling these, you free up more room for savings.

Make Adjustments When Life Changes

Life is not static—and neither is your budget. A new baby, a salary hike, a medical emergency, or moving to a new city can completely change your financial situation. That’s why reviewing your budget every few months is a smart habit. If your expenses go up, see if you can cut back elsewhere. If your income increases, don’t increase all your expenses—increase your savings too. Flexibility is key to long-term financial stability.

Final Thoughts

Creating a monthly budget might sound like a boring task, but for a middle-class Indian family, it’s a powerful step toward a better life. When you know where your money goes, you feel more in control. You can plan for your children’s future, enjoy life without the stress of debt, and build a cushion for unexpected events.

Start small. Involve your spouse and even your children in the process. Make budgeting a monthly family activity. Over time, you’ll build financial habits that will serve your family for years to come.

Budgeting is not about restriction—it’s about empowerment. And the best time to start is today.

FAQs

Q1. What is the first step in creating a monthly budget for a middle-class Indian family?

A: The first step is to calculate your total monthly income, including all sources such as salary, freelance work, rental income, and interest, to know how much money you have available.

Q2. How should I track my expenses effectively?

A: Track every expense for at least one full month, including small daily purchases, and categorize them into fixed, variable, and discretionary expenses for better clarity.

Q3. What is the difference between fixed and variable expenses?

A: Fixed expenses remain constant every month (like rent, loan EMIs, and insurance), while variable expenses fluctuate monthly (like groceries, fuel, and entertainment).

Q4. Why is it important to differentiate between needs and wants?

A: Differentiating helps prioritize essential spending on needs such as food and education, ensuring financial stability and avoiding unnecessary expenses.

Q5. What budgeting rule is recommended for middle-class families?

A: The 50/30/20 rule is recommended: 50% for needs, 30% for wants, and 20% for savings and investments.

Q6. How can I save money effectively while budgeting?

A: By setting clear financial goals, limiting discretionary spending, and consistently allocating a portion of your income to savings and emergency funds.

Q7. What tools can help me maintain my monthly budget?

A: You can use budgeting apps like Walnut or Money Manager, spreadsheets, or a simple notebook to record and monitor your expenses regularly.

Q8. How often should I review my budget?

A: Ideally, review your budget monthly to track your progress, identify any overspending, and adjust your plan as needed.

Q9. Can budgeting help with unexpected expenses?

A: Yes, a well-planned budget includes setting aside an emergency fund, which can cover unexpected costs like medical emergencies or sudden repairs.

Q10. How do I handle fluctuating income in my budget?

A: For variable income, average your earnings over the past 3 to 6 months to set a realistic monthly budget and adjust expenses accordingly.